DeFi, or the finance of the future

DeFi (for ‘Decentralised Finance’) is drawing a lot of attention. This alternative financial system, based on blockchain technology, is…

DeFi (for ‘Decentralised Finance’) is drawing a lot of attention. This alternative financial system, based on blockchain technology, is characterized by an open infrastructure, in terms of its applications and the way it is built. Laying the foundations for a new approach, its aim is to address the many restrictions imposed by the traditional financial system. We explain how and why it will bring about a true revolution in the world of finance.

The traditional financial system and its many limitations

Founded in the early days of the computer age, our current financial system is based on now obsolete infrastructure. Finance has not benefited from the revolutions driven by the Internet: it is and remains based on rigid foundations, whose limits are becoming ever more obvious.

The current financial system is a true oligopoly, where a handful of powerful financial institutions share the cake. With power concentrated in a few hands, corruption, and regular scandals (such as the 2008 crash, the Madoff affair, and the Archegos affair, to name but a few), this system operating behind closed doors is seriously limited, to put it mildly.

What’s more, the banking system as we know it is focused on developed countries. Following a recent study conducted by the World Bank, 3.8 billion adults around the world have a bank account. This means that there are more than 3 billion “unbanked” people.

For customers, this forced dependency on a murky financial system has a cost. They remain at the mercy of financial institutions, which have little incentive to be efficient, and suffer from the inherent slowness of the system (have you ever had to wait three days for a bank transfer?). Furthermore, costs related to the presence of intermediaries (including fees, interest rates, and so on) are directly passed on to consumers.

Lastly, and perhaps most importantly in a world where transparency is becoming a core value, today’s financial system remains totally opaque. Who knows where and how their money is invested? Who knows exactly what activities are funded with their savings? And who sets the terms governing how we use our money (such as withdrawal limits imposed by banks)? This absence of transparency means that, ultimately, consumers are not in control of their money.

The DeFi revolution, for a fully decentralized financial system

In the digital age, the next revolution may well emerge from DeFi. But what is it exactly and what will its future implications be?

As we have seen, DeFi is designed to reshape the financial ecosystem as we know it today, by removing trusted intermediaries such as banks. What is the aim of this? To remove barriers to entry and provide everybody with the same financial products and services.

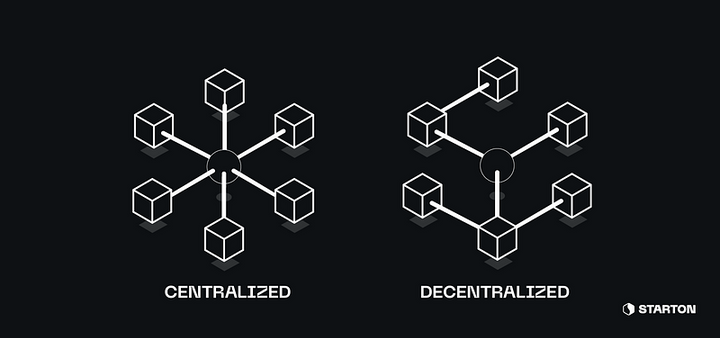

DeFi has three outstanding components: digital technology, decentralization, and openness to all, which influence the way it is used and built. By offering a totally decentralized system that opens up access to all financial products and services (including means of payment, loans, saving accounts, and investments), in an anonymous and secure manner, it is competing directly with the current banking monopoly.

In practical terms, it means that absolutely anybody can, for example, access loans from their home. As long as they have an Internet connection. Even people outside of the banking system can access it. DeFi is a system that can stand up to censorship, as no entity or individual can oppose a transaction between two consenting parties.

The idea is to recreate financial services and products in a decentralized manner, with no go-betweens. Smart contracts, based on blockchain technology, can replace your bank. And, since there are no middlemen in this type of system, all the related fees and commissions disappear.

When it comes to taking out a loan, for example, a request is submitted on a platform in exchange for collateral, i.e. an amount deposited as security (which is escrowed in a smart contract). The collateral acts as a guarantee, which also makes it possible to do away with the usual limitations and requirements, such as proof of permanent employment, and so on.

This absence of barriers to entry can help rebuild a transparent, fair, and instantaneous financial ecosystem.

Today, many exchange platforms are available to access the benefits of DeFi. For example, there are the Uniswap and Pancakeswap platforms, which use a decentralized exchange protocol to enable users to exchange cryptocurrencies.

Make no mistake: this thriving ecosystem is just taking its first steps. Between January and August 2021, the value of exchanges via DeFi grew from 15 to 80 billion US dollars. The mind boggles at what the value could be in years to come…

New players such as Starton are catalyzing this revolution, by creating and providing access to the tools needed to build a new decentralized financial system. It is left to us to imagine all the things that it will be possible to do.